While the Bitcoin market witnessed a huge decline in the month of November, researches were conducted to analyze the root cause and the overall impact on the financial sector. Per

Over the time the bitcoin network has amassed around 460 million addresses. Of course, a holder or any legal entity can have any number of addresses but among that, just 172 million addresses are economically relevant. More precisely the ‘economic’ standpoint refers to addresses which are controlled by individuals or services who currently own Bitcoin, and constitute only 37%. Furthermore, of these 172 million, only 27 million actually hold bitcoin.

Now the question arises from where did these many addresses were created and what happened to those non-economic addresses? Well, the answer to that is,

They are typically single use and hold bitcoin for only a short time. For instance, three-quarters have held bitcoin for less than a day. The majority of these addresses are either change addresses or ‘connective tissue’, meaning they hold bitcoin for a short time to facilitate payments between people and services.

Notably,

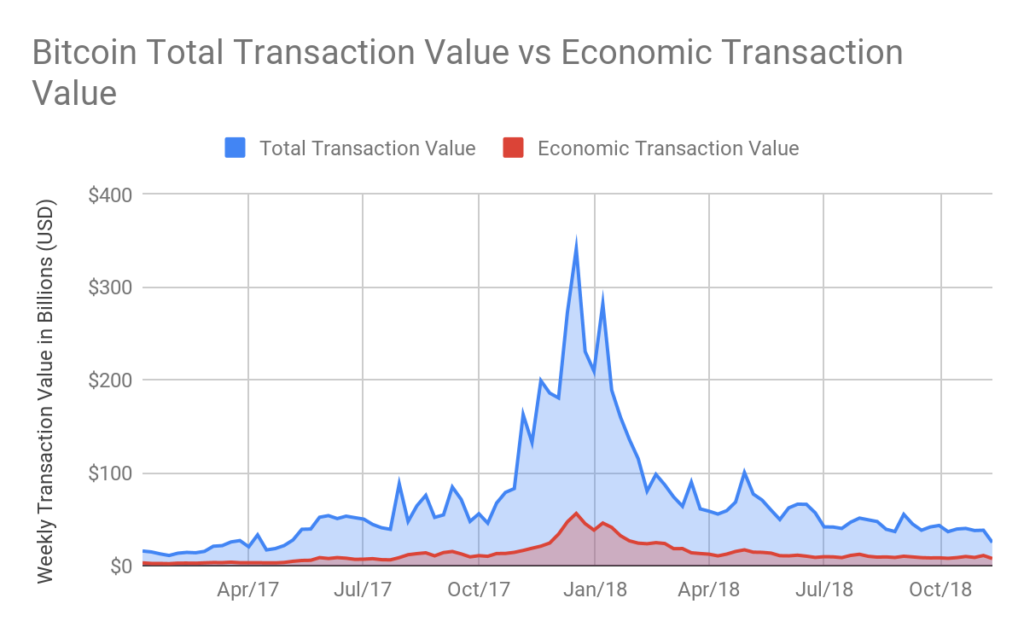

Also, there was a steep increase in the bitcoin flow to personal wallets just before the month of November, almost accounting to $400 million, which was less than $300 million in June – says Bloomberg Certainly, the data results suggest people were trying to accumulate coins at lower prices, says Kim Grauer, an economist at Chainalysis.

In 2018, crypto exchange Coinbase reportedly saw a 20 percent increase in BTC trade volume during OTC (Over the counter)markets hours, while Grayscale’s Bitcoin Investment Trust saw a 35 percent drop in volumes compared with the same period in 2017.

With all these facts, the real transaction volume of the underlying blockchain becomes questionable. Do you think the blockchain technology comes with its own caveats? Let us know in the comment section below.